After the JPEX and HOUNAX scams, another trading platform successfully disappeared in Hong Kong: the cryptocurrency exchange BitForex, claiming to be based in Hong Kong, has completely disappeared from public view after withdrawing nearly $57 million from its hot wallet, leaving users unable to access their accounts. The article is sourced from Gyroscope Finance and was compiled and written by PANews.

Article:

BitForex Runs Away, Leaving Empty Offices Behind

Extensive Overseas Coverage, Numerous Clues, SFC Finally Issues Statement

Regulatory Issues? Or the Worst Outcome?

As we all know, after the JPEX and HOUNAX scams, Hong Kong has been cautious in regulating virtual asset trading platforms, ensuring the protection of investors’ interests through information disclosure and advertising coverage.

Background:

Hong Kong Securities and Futures Commission: Exchanges without licenses “must cease operations”, list of unlicensed exchanges does not include Fire Bee, ByBit, OKX…

However, those in the industry know that prevention is better than cure. With public awareness not improving, trading platforms disappearing have become common in the crypto community, with phishing links, pyramid schemes, and account theft rampant.

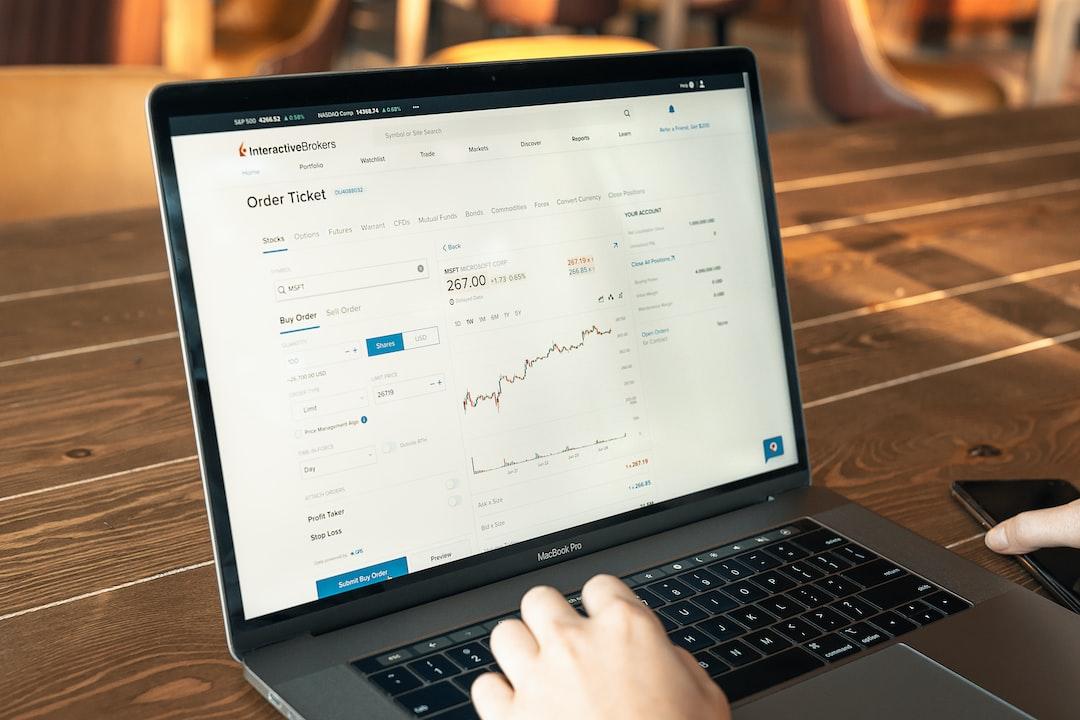

Recently, another trading platform successfully disappeared in Hong Kong, staging an “empty city strategy”. This time, the operation was even more audacious, resorting to action instead of words—directly withdrawing money and running away. On February 23rd, the cryptocurrency exchange BitForex, claiming to be based in Hong Kong, suddenly suspended withdrawals. Prior to this, the platform had used wallet and website maintenance as an excuse to delay user withdrawals. At the same time, as monitored by blockchain detective ZachXBT, around $56.5 million in cryptocurrencies flowed out of three BitForex hot wallets before the exchange stopped processing transactions. On February 26th, the exchange’s website was officially shut down. Users were unable to access their accounts or load the webpage and began seeking help on social media. However, BitForex’s X platform account had not been updated since February 21st, and multiple users on its official Telegram channel reported that they were unable to access their accounts and their balances were not displayed.

The group has 23,413 members, with over 1,000 users currently online waiting for a response from the exchange. According to insider information, one of the administrators of BitForex’s Telegram channel, Hazel_BitForex, has deleted their personal account.

BitForex’s official website can no longer be accessed, image source: BitForex’s official website

Although the official website can no longer be accessed, public information can still be found on LinkedIn. BitForex claims to have 6 million registered users and 51-200 employees. The platform has teams in Germany, Estonia, Singapore, Malaysia, the Philippines, and other countries.

According to information from the Hong Kong Companies Registry, the company was registered in 2018 and is located in the Kwai Fong area of the northern New Territories of Hong Kong. In fact, it was active in mainland China under the Chinese name Coinfu.com for a period of time before being regulated back to overseas regions. The company’s press release also listed several related business locations. However, from the business locations, the truth can be summarized in four words—empty offices.

Here, I will cite the report by DL News’ Hong Kong reporter Callan Quinn, who visited the registered and business locations to provide an explanation. Unlike other crypto companies that register in the city center or gather in the Science Park and Cyberport, this company is located in the industrial area of Tai Leung Village near Kwai Fong, the terminal station of the Tsuen Wan Line, about 40 minutes from the city center.

BitForex’s registered location, image source: Callan Quinn

According to staff members at the registered location, the company primarily provides virtual addresses for mainland Chinese companies that are looking to set up offices in Hong Kong. They currently serve thousands of companies, and BitForex is just one of them. BitForex also lists the company secretary’s address in another corner of the building complex—an office on the second floor of Apartment D/3, which is empty.

The final related location is in the bustling Mong Kok area. Although it was difficult to enter due to the absence of residents, there were letters and packages scattered at the entrance of the office building, corresponding to different company names. It can be inferred that this address is also just one of the virtual addresses provided. Google Maps confirms this fact, showing that multiple companies, not just BitForex, use this address.

The addresses are all false, and the claimed hundreds of employees have long disappeared. This undoubtedly indicates a premeditated scam. The suspension of withdrawals occurred a month after the departure of BitForex’s CEO, Jason Luo, leading users to believe that this was the beginning of an exit scam. According to documents, Jason is the company’s sole shareholder and director and currently resides in Shenzhen.

In fact, regardless of the scam method, the platform has had problems before. Multiple financial regulatory agencies have issued warnings against it. As early as October 2020, the Securities Commission of Malaysia included BitForex on its list of unauthorized warnings.

In April 2023, the Financial Services Agency (FSA) of Japan also accused BitForex of violating the country’s fund settlement regulations. The Financial Conduct Authority of the United Kingdom also disclosed that BitForex had been operating in the country without registration.

However, these issues did not seem to affect the platform’s operations. After exiting the aforementioned regions, in September 2023, BitForex claimed to be one of the world’s leading cryptocurrency exchanges by market value, with a daily trading volume of about $2.6 billion. According to CoinGecko data, from February 22nd to 24th, the exchange’s trading volume dropped from $2.5 billion to $1 billion.

There is currently no data from institutional records tracking the platform. Interestingly, BitForex was previously exposed by Chainalysis for falsifying transaction data, with the platform’s actual liquidity being only 1/800th of the reported trading volume, a shocking level of falsification.

BitForex’s rapid decline in trading volume, source: CoinGecko

With extensive overseas coverage and numerous clues, the SFC finally issued a statement after the platform’s disappearance.

As usual, regulation was slow to respond. On March 4th, after more than a week of suspended withdrawals, the Securities and Futures Commission (SFC) of Hong Kong released an announcement warning the public to be cautious of a virtual asset trading platform operating under the name BitForex, which is suspected of engaging in virtual asset fraud. BitForex is not licensed by the SFC and has not applied for a license to operate a virtual asset trading platform in Hong Kong. The SFC has included it on the list of suspicious virtual asset trading platforms.

In addition, the SFC once again advised investors to be cautious when trading virtual assets on unregulated platforms. If a platform ceases operations, goes bankrupt, is hacked, or any assets are misappropriated, investors may lose all their investments held on the platform.

List of suspicious platforms issued by the SFC, source: SFC

However, prior to this, the SFC had listed 14 suspicious virtual asset trading platforms, and BitForex was not on the list. On February 29th, the SFC announced the deadline for virtual asset trading platform applications, and a total of 21 platforms submitted their application materials. According to regulations, platforms that did not apply for a license by that date must cease operations in Hong Kong by May 31, 2024, and operating without a license is a criminal offense. Perhaps this was the final straw that broke BitForex’s back.

In terms of impact, this platform incident is not as far-reaching as the JPEX case, and it is difficult to trace the follow-up handling. However, whether the new founder can be found and the stolen funds can be recovered are still major question marks at the moment. The worst outcome may be just another unsolved case and another harsh reality lesson for investors.

Related Reports

NFT project exposed as a rug pull! Hong Kong exchange HKD.com partners with ESG, claiming no connection?

In addition to JPEX, Hong Kong SFC reveals five other “suspicious” cryptocurrency exchanges

Futu NiuNiu ventures into cryptocurrency! Group affiliate Panthertrade applies for VASP exchange license from the Hong Kong SFC