Bitcoin recently surged to $73,000 before dropping below $67,000, making it difficult for the market to determine its future direction. This article compiles data on stablecoin market capitalization, altcoin market capitalization, and Bitcoin ETF to help readers assess the future market. The article is based on the work of cryptocurrency KOL, Riyue Xiaochu, and is organized and written by PANews.

Table of Contents:

Important Data to Help Make Decisions for the Future

Analysis of Stablecoin Market Capitalization

Analysis of Altcoin Market Capitalization

ETF Data Analysis

Trends in US and Asian Funds

BTC Whale Data Analysis

Important Data to Help Make Decisions for the Future

1) Since BTC was priced at $38,000, the total market capitalization of stablecoins has increased by $11 billion. Last week, there was a significant increase, with stablecoins issuing an additional $3.7 billion.

2) Starting from March 6th, the main source of BTC buying pressure has shifted to Asian funds. There are signs of withdrawal from US funds, as BTC fell by 15% in the US time zone, which is not a good sign.

3) ETF has a total inflow of $9.5 billion, so the inflow of stablecoin funds still exceeds that of ETF, making it the biggest driving force behind the rise of the entire cryptocurrency market. However, ETF can only buy BTC, so the funds of ETF have a dominant position in BTC’s rise.

4) In terms of BTC whales, in the past week, the number of addresses with more than 1,000 BTC decreased by 50, while the number of addresses with more than 100 BTC increased by 86.

Analysis of Stablecoin Market Capitalization

Looking at the total market capitalization of stablecoins, here are some data points:

The lowest point of this round of market, which was September 10, 2023, had a total stablecoin market capitalization of $121 billion.

The lowest point after the ETF approval was when BTC adjusted to $38,500, which was January 23, 2024, with a total stablecoin market capitalization of $128.3 billion.

Last Monday, the total stablecoin market capitalization was $135.6 billion.

This Monday, the total stablecoin market capitalization was $139.3 billion.

In other words, from the start of the previous round of market to the lowest point after the ETF approval, stablecoins issued an additional $7.3 billion. In the past month, stablecoins have issued a total of $11 billion, with a significant increase of $3.7 billion last week.

For mainstream stablecoins USDT and USDC, since September 10, 2023, USDT has increased from $82.9 billion to $102 billion, an increase of $19.1 billion. USDC has increased from $26.1 billion to $30.2 billion, an increase of $3.9 billion.

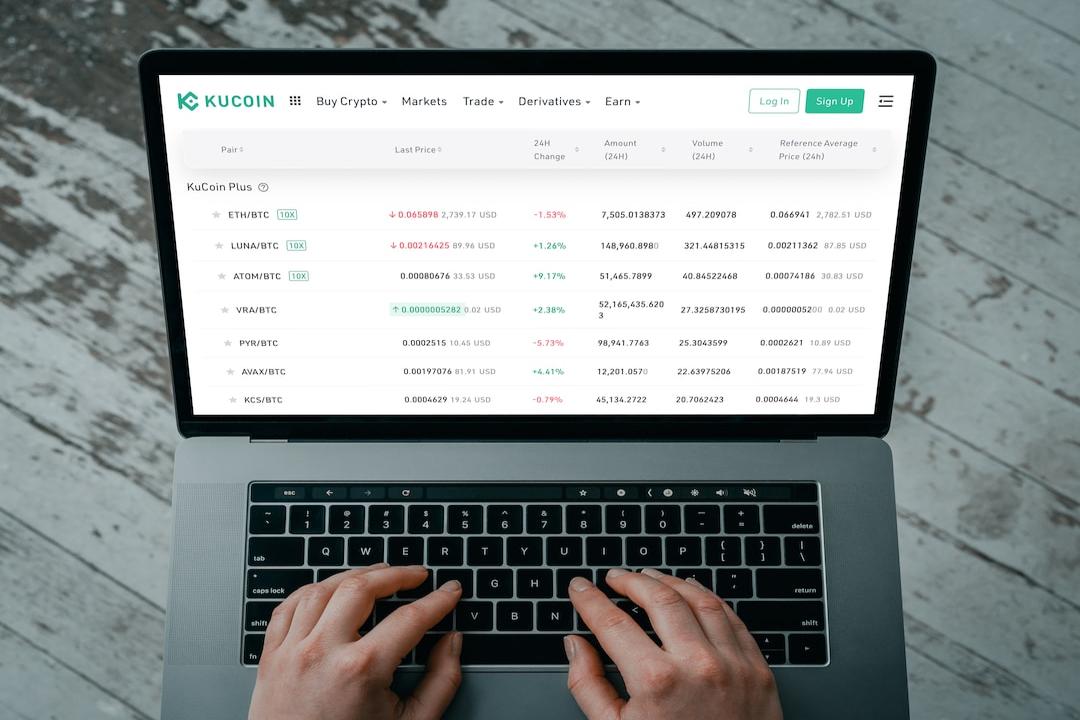

[Image]

Analysis of Altcoin Market Capitalization

In the above chart:

Black represents the total market capitalization of cryptocurrencies.

Green represents the total market capitalization of cryptocurrencies excluding BTC and ETH.

Orange represents the total market capitalization of USDT.

From the chart above, we can intuitively see that:

1) Since the bottom in September 2023, the growth of the total market capitalization of BTC+ETH has been significantly higher than other altcoins, most of the time surpassing them. So, first of all, congratulations to those who hold a large amount of BTC and ETH. Secondly, if your current gains cannot outperform BTC and ETH, do not doubt yourself. Don’t pay attention to those who claim to have made tens of times their investment all over the internet. The actual overall returns of altcoins are lagging behind BTC and ETH.

2) The growth rate of USDT market capitalization is clearly lower than that of cryptocurrencies. This is due to two reasons:

– The funds from ETF and US dollar funds dominated by Coinbase.

– The higher the market goes, the more people adopt a strategy of holding positions without moving. Therefore, a large amount of funds is not needed to drive the market.

[Image]

ETF Data Analysis

[Image]

From the ETF data, as of March 8th, the net assets of ETF holding BTC are $55 billion. The cumulative net inflow is $9.5 billion, while stablecoins have issued $11 billion. Therefore, the inflow of stablecoin funds still exceeds the inflow of ETF funds, making it the biggest driving force behind the rise of the entire cryptocurrency market. However, we know that ETF funds can only be used to buy BTC, while stablecoin funds include other altcoins. Therefore, in terms of BTC’s rise, ETF funds have a dominant position.

From the relationship between the price and net inflow of ETF, it is evident that ETF is highly correlated with BTC price. Around January 20th, when there was a net outflow, BTC was in a state of falling to its bottom. When there was a net inflow, BTC was in an upward trend. In other words, US ETF funds are the main factor driving the price of BTC.

Trends in US and Asian Funds

Looking at the contributions to the rise of BTC from different time zones over the past month, initially, the US time zone was in a leading position, with the US being the biggest driving force behind BTC’s rise, and Asian funds contributing relatively less. However, starting from March 6th, there are signs of withdrawal from US funds, and BTC fell by 15% in the US time zone. The main source of buying pressure has shifted to Asian funds.

Looking at the cumulative contributions of funds from different time zones over the past month, Asian funds have far surpassed US funds in contributing to the rise of BTC. Historically, the sustainability of Asian funds is not long, so this may not be a very good signal.

[Image]

BTC Whale Data Analysis

Over the past month, the amount of BTC held on exchanges has been in a downward trend, decreasing from 2.363 million to 2.280 million, a net outflow of 83,000 BTC. At the same time, the number of addresses holding more than 10,000 BTC has decreased by 1, and the number of addresses holding more than 1,000 BTC has decreased by 9, while the number of addresses holding 100 BTC has increased by 190.

Therefore, the net outflow on BTC exchanges is mainly from large holders with holdings of around 100 BTC. Looking at the data from the past week, the amount of BTC held on exchanges continues to decline, and the number of addresses holding more than 10,000 BTC has not changed. However, there has been a significant decrease in the number of addresses holding 1,000 BTC, with a decrease of about 50, while the number of addresses holding 100 BTC has increased by about 80.

[Image]

Related Reports

Bitcoin Hits Bottom at $50,000! Galaxy Digital Founder: Spot ETF Funds Push BTC to $100,000

Middle Eastern Sovereign Fund “Qatar” Rumored to Invest $500 Billion in Bitcoin, Countdown to BTC Breaking $100,000?

Learn from MicroStrategy’s Bitcoin Buying Frenzy? Coinbase Issues $1.1 Billion Convertible Bond, Stock Price Surges 60% this Year.