According to 10x Research, the average buying price of Bitcoin spot ETF buyers in the United States is about $57,300. Currently, BTC is oscillating around this level, and whether it will become a strong support for prices remains to be seen.

(Background:

Interest rate freeze for the sixth time: Powell has no confidence in when to cut interest rates, and slows down quantitative tightening in June. Bitcoin and Ethereum roller coaster ride.)

Table of Contents:

10x Research: Average buying price of Bitcoin spot ETF buyers in the United States is about $57,300

Standard Chartered Bank analyst: BTC may further drop to $50,000

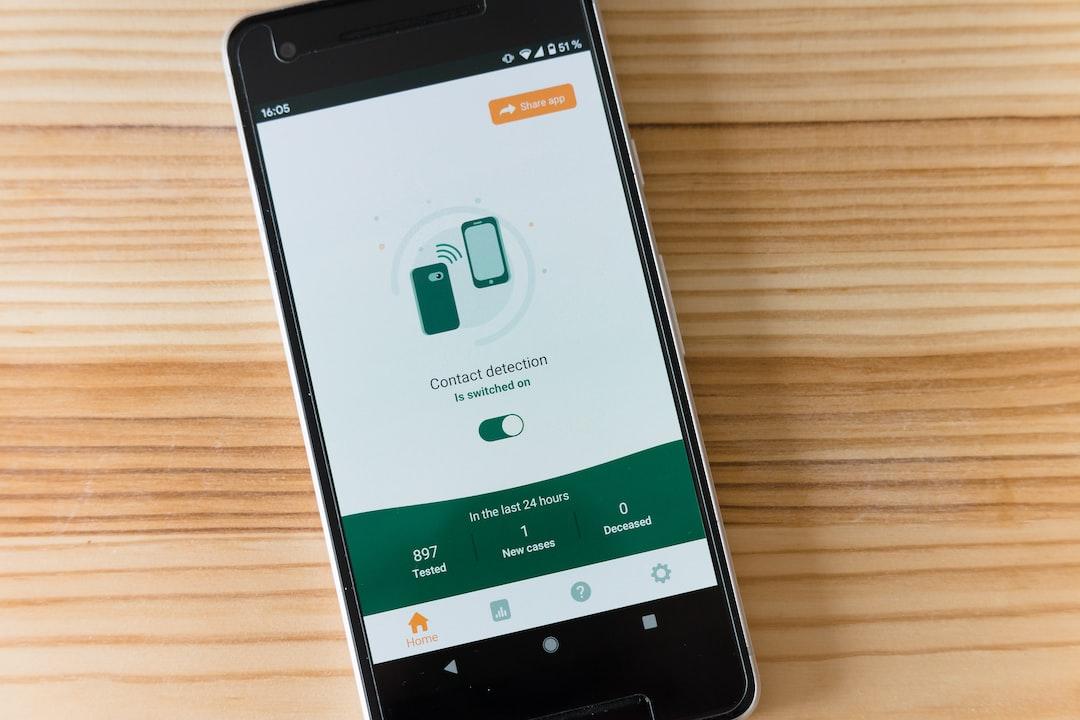

Bitcoin spot ETF in the United States sets a new record of six consecutive days of net outflows

Bitcoin is currently facing the most severe headwinds in two months, with a maximum decline of over 12% in the past three days. The Federal Reserve decided to keep the federal funds rate at 5.25-5.5% for the sixth time in a row. Although Powell stated that there is no intention to further raise interest rates and will slow down quantitative tightening starting in June, the overall stance is dovish.

However, Bitcoin fell below $57,000 again around 9:30 a.m. today (2).

Since yesterday afternoon (1), Bitcoin has fallen below $57,000 more than five times and then rebounded. At that time, the cryptocurrency research institution 10x Research stated:

Currently, if this price level is indeed the average entry price of the Bitcoin spot ETF in the United States and it has been unable to break through for a long time, it could indeed become a price support for BTC at the moment.

However, not all analysts hold the same view. According to The Block, Standard Chartered Bank’s head of foreign exchange and digital asset research, Geoffrey Kendrick, stated:

At the same time, Kendrick mentioned that the US spot Bitcoin funds have had five consecutive days of net outflows, and the average purchase price of the ETF is currently below $58,000, posing a clearing risk. He also added that the poor response to the spot Bitcoin and Ethereum ETF launched in Hong Kong this week may also be the reason for the recent decline in Bitcoin prices.

According to SoSoValue data, as of April 30th, Eastern Time, Bitcoin spot ETF has seen five consecutive days of net outflows. And according to the platform’s estimation, there was also a continuous outflow on the 1st, which means that this will set the longest outflow record in a month (six consecutive days), which is not good news for BTC prices.

As of the time of writing, the net asset value of the Bitcoin spot ETF is $47.72 billion, and the ETF’s net asset ratio (the proportion of market value to the total market value of Bitcoin) is about 4%.

Related Reports

As the Bitcoin halving approaches next week, which BTC L2 projects are worth paying attention to?

“Bitcoin Enthusiast” Argentine President’s image has reversed! Proposal to regulate domestic traders faces criticism

Bitcoin plummets before halving, what’s next? 9 indicators to help you judge the turning point.