Assuming that the Bitcoin spot ETF is approved, the scale of Bitcoin held by various issuers will undoubtedly become the focus of the market’s attention. According to data from SpotOnChain, in the past three months, 5 billion USDT stablecoins have been minted on the Ethereum network, of which 2.95 billion have directly entered a specific wallet address starting with 0x1db, and have been deposited into different centralized exchanges.

(Previous summary:

Fake! SEC Twitter account hacked, spreading “approval of spot ETF” fake news, causing Bitcoin to surge to $48,000 and then sharply drop)

(Background information:

Battle for spot ETF begins! Vaneck and BlackRock each invest $72.5 million and $10 million in seed funds)

Whether the US Securities and Exchange Commission (SEC) will approve the first Bitcoin spot ETF has become the focus of the market this week. The scale of the seed funds invested by various issuers has also attracted much attention. According to the latest S-1 amended documents, VanEck has injected $72.5 million in seed funds into its Bitcoin spot ETF, BlackRock has injected $10 million in seed funds, and Fidelity has injected $20 million in seed funds.

Has 2.95 billion USDT already entered the market to position Bitcoin?

It is worth noting that according to SpotOnChain data, in the past three months, 5 billion USDT stablecoins have been minted on the Ethereum network, of which 2.95 billion have directly flowed into a wallet address starting with 0x1db, and have subsequently been deposited into different centralized exchanges. Such a large amount of funds has led investors to speculate whether ETF institutions have already entered the market and purchased Bitcoin spot in advance.

According to SpotOnChain, out of the 2.95 billion USDT, 1.76 billion have flowed into Coinbase, 517 million have flowed into Kraken, 434 million have flowed into Binance, and 232 million have flowed into Kraken.

Source: Spotonchain

Vaneck estimates: Bitcoin spot ETF will reach a $40 billion market in the next two years

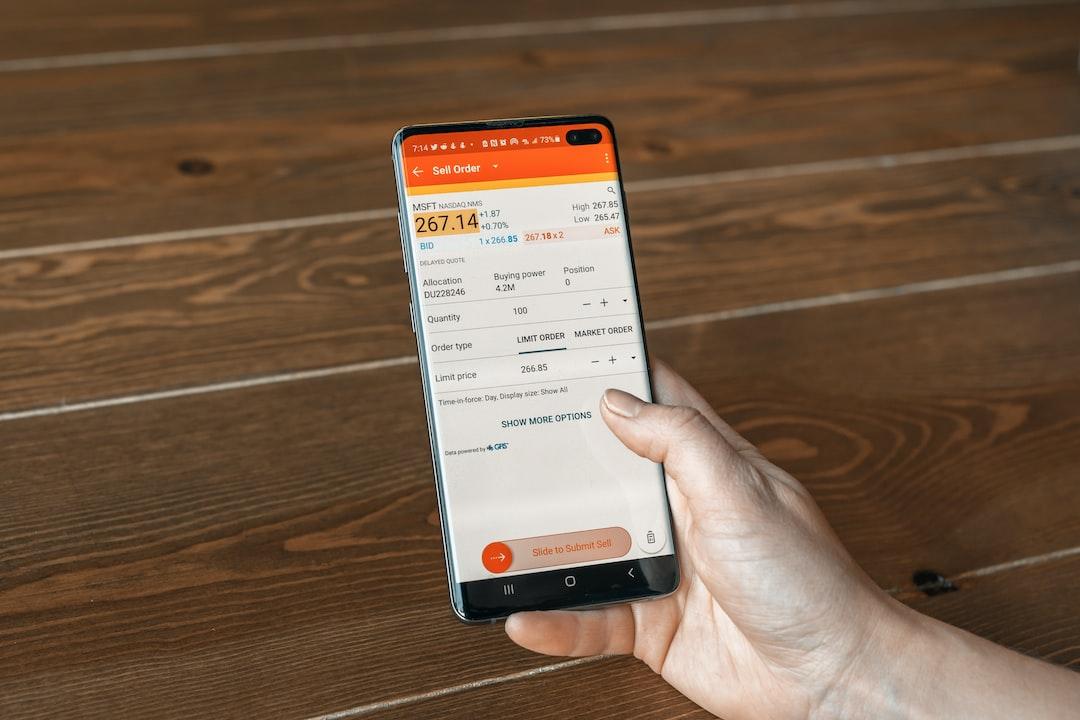

In fact, spot ETFs approved by the SEC are explicitly required to adopt the “cash creation/redemption” model. In this model, authorized participants (APs) use cash to create or redeem shares of the Bitcoin spot ETF. This means that authorized participants will provide cash to the ETF fund, and fund managers of major institutions will use this cash to purchase Bitcoin.

Previously, Matthew, the head of digital research at VanEck, stated in an interview with THE BLOCK that there were rumors that BlackRock had arranged over $2 billion in capital flows for the new ETF in the first week, which came from existing Bitcoin holders. Given this, the notion that institutions have already positioned themselves in Bitcoin spot over the past three months is not unfounded.

On the other hand, Matthew stated that if $2 billion in transactions did indeed occur in the first week, it would far exceed VanEck’s expectations. Based on the trading volume of the first gold ETF, they expect the first-quarter trading volume to be $2.5 billion. Based on similar analysis, they conservatively estimate that the Bitcoin spot ETF will reach a $40 billion market in the next two years.

Related Report

Standard Chartered Bank predicts Bitcoin spot ETF to attract “massive $100 billion investment”! BTC to rise to $200,000 in two years.

ETF Godfather: Bitcoin spot ETF may initially trade at an “8% premium”.

Key details to watch for during the “most crucial week” for Bitcoin spot ETF approval.