CoinMarketCap data shows that the trading volume of dYdX v4 has surpassed that of Uniswap v3 in the past 24 hours, making it the largest decentralized exchange (DEX) in terms of daily trading volume.

(Previous summary:

Why did dYdX choose to launch its own chain?

)

(Background supplement:

User growth and stagnant trading volume, what is the future of perpetual contract DEX?

In October last year, the decentralized perpetual contract exchange dYdX officially launched version 4, transitioning from the Ethereum Layer2 network to an independent blockchain on Cosmos, with the goal of achieving “complete decentralization” in its market, so that its order book and matching engine no longer operate in a centralized manner.

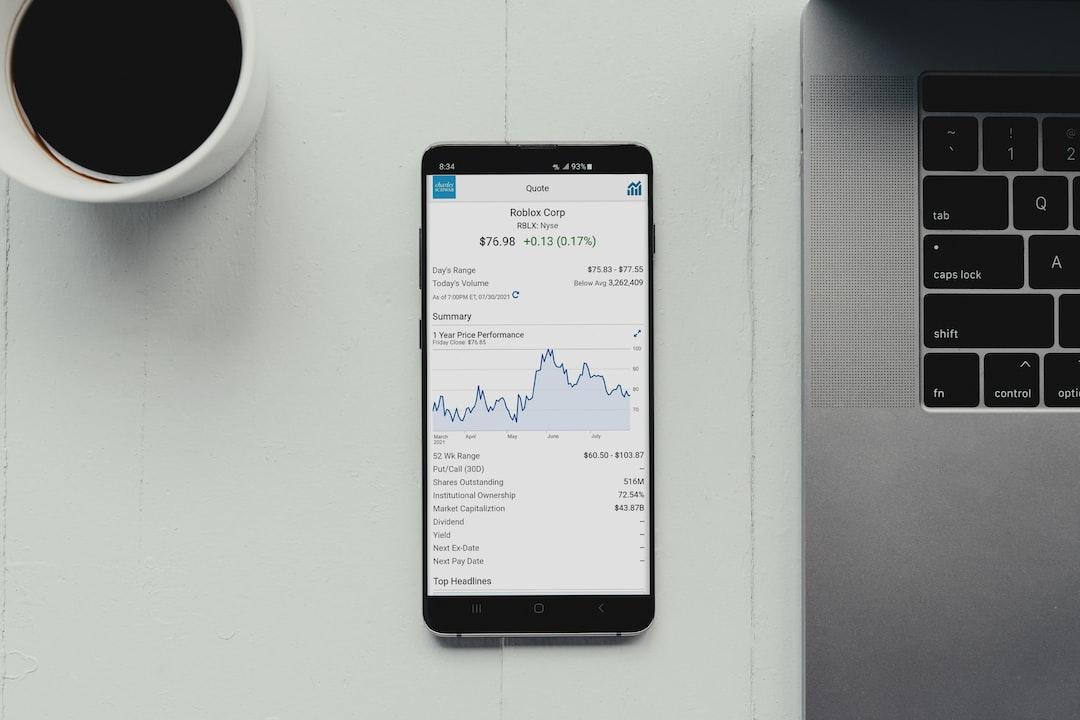

It is worth noting that according to CoinMarketCap data, the trading volume of dYdX v4 in the past 24 hours reached $633 million, surpassing the leading DEX Uniswap v3 on the Ethereum chain, which had a trading volume of $522 million, making it the largest decentralized exchange in terms of daily trading volume. The still-operating dYdX v3 has a trading volume of up to $482 million in the past 24 hours, ranking third.

However, in terms of TVL (total value locked), DefiLlama data shows that Uniswap has a total locked value of $4.42 billion, far exceeding dYdX’s $332 million.

Further reading:

In-depth analysis: Trends, competition, and investment value of perpetual contract DEX

dYdX v4 surpasses Uniswap in 24-hour trading volume. Source: CoinMarketCap

dYdX successfully transitioned from Ethereum to an independent chain on Cosmos

According to Coindesk, dYdX stated that the total trading volume since the launch of v4 is $17.8 billion, while dYdX v3 had a total trading volume of over $1 trillion in 2023, with daily trading volumes exceeding $2 billion on some days.

Based on the current trading volume performance, dYdX v4 has surpassed Uniswap and other Ethereum-based DEXs, including dYdX’s own v3, dispelling concerns about its transition from Ethereum to the independent chain on Cosmos and potential decrease in usage. dYdX stated that the v3 on Ethereum will eventually be closed, but the end date has not been determined yet.

Regarding the impressive trading volume performance of dYdX v4, Paul Veradittakit, the President and Managing Partner of cryptocurrency fund Pantera Capital, commented:

DYDX surged nearly 16% in the past two weeks

In terms of token price, the native token DYDX of dYdX has increased by over 15.8% in the past two weeks, reaching $3.05 before the deadline, with a 3.9% increase in the past 24 hours.

Source: CoinGecko

Related Reports

Reviewing the significant events in decentralized exchanges (DEX) in 2023, rise and challenges

Even small retail investors can easily become profitable market makers? Dyson Finance may be the most innovative DEX this year

DeFi Battle Royale: Why is Uniswap X accused of copying CowSwap? What are the new directions for future DEXs?

Is decentralized exchange (DEX) legal in China?