According to Whale Alert monitoring, two dormant Bitcoin whales holding 404 and 429 Bitcoins respectively (totaling $80.77 million) for 10.9 years began to be active simultaneously four hours ago. It is currently uncertain whether this revival is for arbitrage selling. However, given the amount of Bitcoin held by the whales, even if they choose to sell, the impact on Bitcoin prices would be relatively limited.

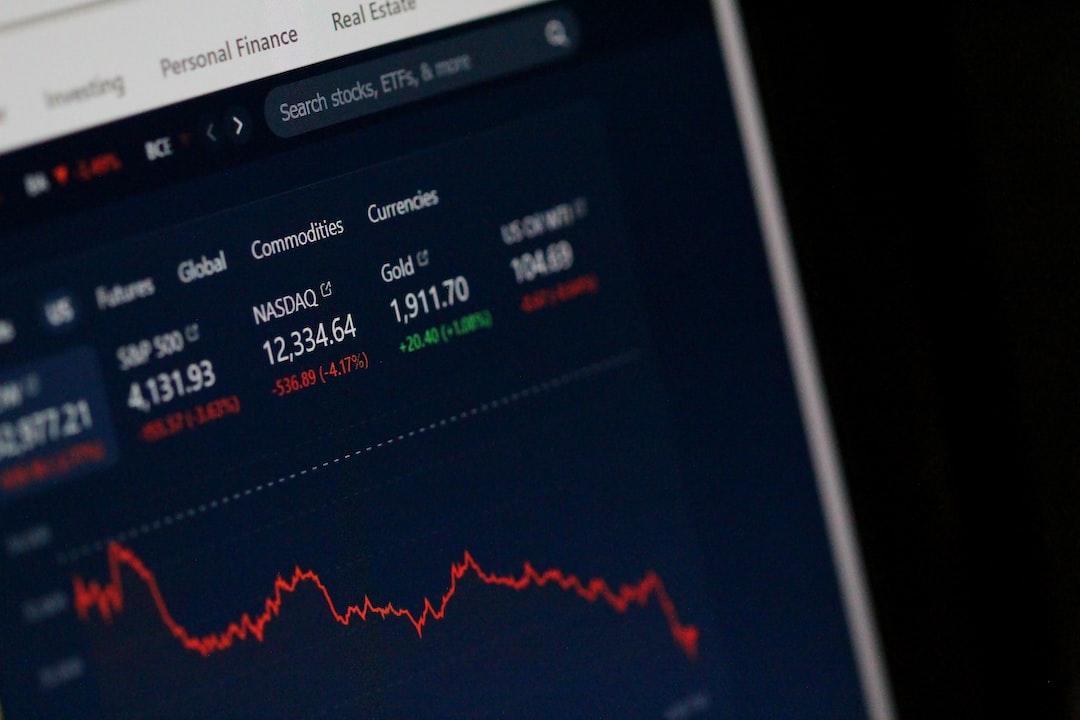

After Donald Trump won the presidential election, market expectations for his promised cryptocurrency policies surged, driving Bitcoin to soar from $69,000 to over $99,000, attempting to break the $100,000 mark. Against the backdrop of Bitcoin’s surge, not only existing Bitcoin holders have started to profit, but even Bitcoin whales’ wallets that have been dormant for over 10 years have begun to stir.

Bitcoin whale holding 404 coins awakens after nearly 11 years

According to the online monitoring account Whale Alert, two Bitcoin whales holding 404 and 429 Bitcoins respectively (totaling $80.77 million) and dormant for 10.9 years started to be active four hours ago. It is currently uncertain whether this revival is for arbitrage selling. However, given the amount of Bitcoin held by these two whales, even if they choose to sell, the impact on Bitcoin prices would be relatively limited, so investors need not worry excessively.

Bitcoin research institution: Satoshi Nakamoto may be the 2010 whale

On the other hand, according to previous reports from Dynamism District, the Bitcoin research institution BTCparser proposed a new theory in an article published on November 19th, suggesting that “Satoshi Nakamoto may be the 2010 Bitcoin whale.”

The article suggests that Satoshi Nakamoto likely mined Bitcoin again in 2010 under a different identity and accumulated thousands of Bitcoins. As prices rose, he strategically began to sell these tokens after 2019.

As of now, this “2010 whale” has transferred 24,000 Bitcoins through the same pattern, with the first transfer occurring in November 2019 and the most recent on November 15, 2024:

– November 2019: Sold Bitcoins worth about $5 million

– March 2020: Sold Bitcoins worth about $6-8 million

– October 2020: Sold Bitcoins worth $11-13 million

– November 2024: Sold Bitcoins worth $176 million

The article indicates that these transaction amounts have gradually increased as Bitcoin prices rise, showing that this whale is strategically implementing a cash-out strategy.